|

Make every credit card payment count...positively!

Catch Up on Past-Due Accounts. If you're behind on your bills, bring them current. While a late payment can remain on your credit report for up to 7 years, having all your accounts current can be good for your scores. Additionally, it stops further late payments from being added to your credit history as well as additional late fees. Pay Down Revolving Account Balances. Even if you're not behind on your bills, having a high balance on revolving credit accounts can lead to a high credit utilization rate and hurt your scores. Revolving accounts include credit cards and lines of credit i.e., Conn’s, Best Buy, other department stores, etc. Maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits. Split your payment in half and pay twice. Credit card interest isn’t calculated based on how much you owe on the due date or at the end of a billing period. Instead, if you carry a balance from one month to the next, your interest is based on your average daily balance. Because of this, making smaller payments more frequently can reduce the amount of interest you owe. Automate your payments. For any method you use, automating your payments allows you to commit to a monthly budget for reducing your credit card debt. Take advantage of any ability to rearrange your credit card payment dates to better align with your paychecks. Don’t close unused credit cards. By closing an old or unused card, you are essentially wiping away some of your available credit and thereby increasing your credit utilization ratio. If you are tempted to close a card to keep from swiping it thus overextending yourself financially, the next tip is especially important for you.

2 Comments

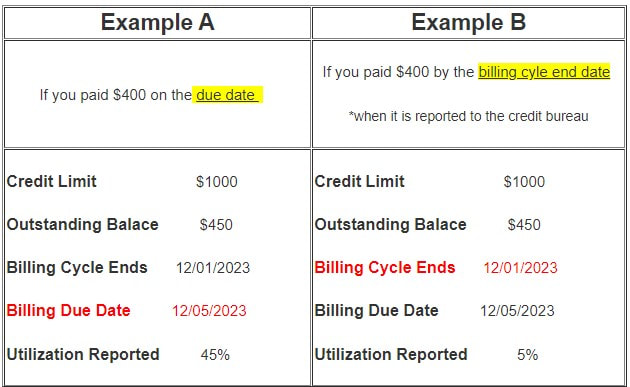

Pay Credit Card Balances Strategically The portion of your credit limits you're using at any given time is called your credit utilization. A good guideline is to never have more than 30% of the limit on any card reported to the credit bureaus and lower is even better. The highest scorers use less than 7%. You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that's what is used in calculating your score. A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low. Be careful not to confuse the billing cycle with your billing due date. Example: If you have a credit card with a $1,000 limit and your outstanding balance is $450, your credit utilization is about 45%. Utilization heavily influences the portion of your credit score that’s determined by amounts owed. In Example A, the payment (billing due date) is due on the 5th of each month, but the issuer reports the balance on the 1st (billing cycle end date). If the issuer reported a $450 balance on the 1st, the credit bureaus would see a 45% utilization ratio even though $400 was paid on the due date. In Example B, if the $400 is paid before 12/1/2023 (billing cycle end date) your utilization would be 5% granted that you did not charge the card before the balance was reported.

A 5% utilization will impact your credit score in two ways: (1) on-time payment and (2) low credit utilization. See chart Most creditors report your balance to the credit bureaus on a certain day of each month which may not be your billing cycle end date nor your due date. Contact your creditors and find out the date they report to the credit bureaus. Do not allow them to simply give you your previously known due date. Be very clear in asking for the date in which they report your credit balance to the credit bureaus. If the person you are speaking with seems confused or doesn't sound confident, you should try calling again to speak with someone else, or ask for a supervisor. This is too important to not get the correct information. |

Details

AuthorThe Hennigan Realty Group blogs are a collective of information, experience, and expertise of the Hennigan Realty team. We have kept the information shared within the blogs general to provide foundational information that each person can build from. We are aware that everyone's real estate experience is unique and there is not a one-size fits all when it comes to buying or selling property. If you would like to gather more in-depth and specific requirements for your wants and needs, reach out to us directly.

|

|

Proudly powered by Weebly

|